Stores have a big problem: 14.2 billion square feet of space designed for a different time. A time when purchasing decisions were made shelf-side, when brick-and-mortar retailers were the only game in town, and online retailers hadn’t yet upended consumer expectations of what shopping should be.

What does this shift suggest about the future design of stores and America’s oversupply of retail space? A recent research study, The Next Killer App: Stores, that surveyed more than 1500 consumers, suggests a radical shift in retail design is in order. Changing consumer expectations means retailers must rethink how they use the 46.6 square feet of store space they maintain for every person in the U.S.

More specifically, this study investigated the BOPIS (buy online, pick up in store) phenomenon. BOPIS is a key strategy for retailers who want to win back customers from online retailers. Done right, BOPIS combines the best of online and in-store experiences and addresses retail space excess. Most importantly, the study results point to a way to transform underutilized real estate inside the store while bringing new meaning and relevance to the shopping experience.

The role of stores in the lives of consumers must evolve. Retailers have offloaded the burden of fulfillment to consumers for far too long. Stores deliberately organize space to force consumers out of their way for basic items, so to spend money, consumers are forced to waste time. Online retailers thrive with a model that saves shoppers time by putting them in control.

THE GROWTH OF BOPIS

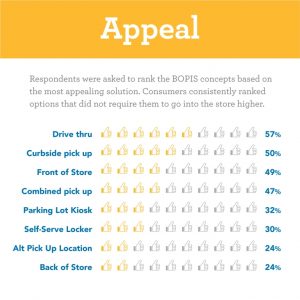

The research team behind this study brought to life the most appealing BOPIS concepts and asked consumers to rate their appeal to discover how stores can best execute BOPIS. One finding is particularly troubling for retailers: people don’t want to go into stores. Respondents overwhelmingly favored BOPIS concepts like drive-thru or curbside pickup that don’t require them to set foot inside the store.

These findings suggest a pattern of shifting preferences across all demographic groups; especially younger shoppers. By a significant margin, the most popular BOPIS concept tested was the drive-thru, which 57 percent of all respondents rated as appealing. Young people (a.k.a. millennials) found this concept most appealing – 62 percent – compared with only 49 percent of baby boomers. Is this just because young people grew up eating “Happy Meals” in the backseats of minivans, or does it reflect a more fundamental shift in consumer norms?

Advertisement

An even larger intergenerational preference gap was found for two other concepts – combined retailer pickup and self-serve lockers. Combined retailer pickup is a subscription-based service that would gather online purchases from multiple retailers at a single, central location. Among young people, 54 percent found this concept appealing, compared with just 38 percent of boomers. The gap was wider still for self-serve lockers; young people rated this concept nearly twice as appealing as boomers did; 39 percent for the former compared to 21 percent for the latter.

Millennials came of age with the Internet, and their preferences and expectations as consumers were shaped accordingly. This shift in consumer sentiment will continue. Consider that soon Amazon won’t even make consumers go to a website. With its new Fire smartphone, consumers can scan almost anything – a shirt, a football, a box of cereal – and it’s delivered in days. If the entire world is now a store, how do stores compete against the world?

IMMERSIVE AND INVITING STORES

Consumers across all demographics in our study – young people most of all – sent a clear signal that they are no longer willing to bear the burden of fulfillment. BOPIS is part of the solution, but it’s only a partial fix. To not only survive but thrive in this era of new consumer preferences, stores will have to do more than merely provide function and convenience. They must succeed where online retail can’t venture: in the realm of immersive experiences at the human scale.

Layout is one basic area where stores must improve. While consumers have expressed satisfaction with the location and hours of stores, they are less happy with layout and cleanliness. According to the American Consumer Satisfaction Index, location and hours are the top-rated attributes for three out of four categories of retail. But for two of these categories – department/discount stores and supermarkets – layout and cleanliness was rated in the bottom half of attributes.

Better layouts are vital for turning browsers into buyers. It’s also a must-have to beat online retailers. As one young person respondent told us, it makes no sense to go to a store, “if you have to spend 20 minutes spending time looking for something when you can just type into a search bar.” For brick-and-mortar to prevail, stepping into a store must be more appealing than staring at a screen. Stores need to be interesting and inviting rather than overwhelming and frustrating. Good design and layout can make that happen.

This in-depth analysis provides explanations for why people don’t want to go to stores, and what might be done to reverse this trend:

Advertisement

Stores need to be social playgrounds.

Meeting functional needs better is where stores need to start, but this isn’t enough. To stay relevant, stores need to become third spaces that meet social needs – places for experience, play, inspiration and discovery. Another young person respondent told us, “It’s a social thing. A reason to get out of the house with friends. You bring them along to get their opinion.” Stores need to be places where people want to gather, go on an adventure and come out on the other side having had a fulfilling, emotional experience. Stores must provide the “thrill of the hunt” and “you had to be there” experiences that online shopping can’t begin to approach. Shopping must feel like an experience, not a transaction. At the very least, this means getting design basics right to provide proper ambience: intuitive layout, good lighting, minimal clutter and interesting focal points. If customers’ experiential needs are met, sales will follow.

Stores need to be hybrid spaces: stores and fulfillment centers.

Stores will always be places where people come to buy things. But they must be much more than that in this new era of consumer preferences. For some shoppers, stores will be the point of fulfillment; for others they will be a gateway to the website. Consumers rate “in-store only” experiences highly: instant ownership (79 percent) and touch and feel (75 percent) were the two highest-rated features of the shopping experience, discovered in another recent WD study. But people aren’t happy interacting with sales associates; only 24 percent of consumers rated associates as having influence on their purchase decision. That has to change, because 71 percent of consumers have reported ending their relationship with a company due to poor customer service.

Finally, the store of the past isn’t meeting the functional or experiential desires of shoppers today, let alone the shopper of tomorrow.

This demands a radical reinvention of traditional store design. Retailers must fundamentally rethink how fulfillment happens in order to rival or best the convenience provided by online retailers. A BOPIS strategy is a must-have for this purpose, but it’s just a start. Consumers want stores that don’t only make shopping convenient, but also make it an interesting, emotionally gratifying experience. That’s good news for brick-and-mortar stores, because with good design, they can give consumers the kind of social, immersive experiences that online retailers can’t. Retailers are sitting on an expansive amount of shopping space. It’s time to use it better.

Lee Peterson is executive vice president, brand, strategy & design, WD Partners, a global design firm based in Dublin, Ohio. He has spoken on this topic at IRDC. To purchase the full study, go to http://www.wdpartners.com/research/the-next-killer-app-stores/

Photo Gallery1 week ago

Photo Gallery1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines2 days ago

Headlines2 days ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Designer Dozen2 weeks ago

Designer Dozen2 weeks ago

Designer Dozen6 days ago

Designer Dozen6 days ago

Headlines1 week ago

Headlines1 week ago