At a time when the retail industry is dealing with consolidation, budget crunches, Internet competition and choppy economic issues, store design consultants remain an upbeat bunch.

According to Lee Peterson, vp, brand and creative services, at WD Partners (Dublin, Ohio), it’s because designers offer exactly what retailers need: innovation.

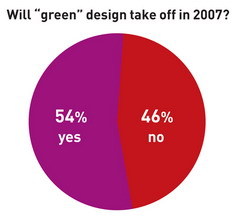

“Our market is a hot place to be right now,” says Peterson. “Every retailer and restaurateur is faced with massive changes: increased competition from the Internet, over-development, greener design requirements and price wars, to name just a few. These ongoing, high-impact changes play exactly to what we do: provide innovation. If we can do that successfully – which most of us left standing have proven we can – we will win big, and so will the people who hire us.”

And those opportunities are not just in the U.S. Like many other design firms, Peterson’s company is looking farther afield for business. WD, which opened its first overseas office in Kuala Lampur in 2005, plans to open one in Mumbai, India, in the coming year. “India is growing like mad, and we’d like to be a part of that,” he notes.

Roughly two-thirds of the companies that responded to our annual Retail Design Firm survey (most of which are based in the U.S.) say they are doing more work overseas. In addition to India, firms say they’ve found fertile ground in China, Japan, Korea, Mexico, Russia, the United Arab Emirates and the United Kingdom.

DIGGING UP DINOSAURS

Back in the U.S., much of the opportunity is coming from mall makeovers. “There are a ton of malls built 20 to 30 years ago that need renovation to make them attractive again to shoppers, and designing these updates for the landlord side of the lease line is one of our fastest-growing markets,” says David Kepron, principal, retail design, at spg3 (Philadelphia).

Advertisement

These renovations – which Kepron characterizes as “digging up the dinosaur” – also create new opportunities on the tenant side of the equation. “The malls’ architecture is usually changed to accommodate a new tenant mix that often includes national restaurant chains, big-box booksellers, large-format sporting goods stores and so on,” Kepron explains. “That reconfiguring process means many existing specialty retailers get bumped to new locations that call for new designs.”

Christian Davies, vp, creative director, of FRCH Design Worldwide (Cincinnati), is upbeat about the coming year because “we have some major retailers out there who have some sizable work to do to realize their potential.”

“I think we were optimistic last year because a lot of great stuff seemed to be brewing, in terms of retail design and consumer behavior,” Davies explains. “Though much of that opportunity was not capitalized on in 2006, it does not necessarily mean that those conditions have gone away. So I think there is great cause for optimism in 2007. Product needs to be on trend and the retail experiences need to be rich and multifaceted in support of this.

“This can be the start of something big, as long as retailers and their designers can deliver. If they fail to do so for yet another year, I think we will go into 2008 with a very disenchanted consumer.”

ADDED COMPLEXITY

There are other challenges, as well. Retailers’ tight budgets, less design work due to retail mergers, competition from other design firms and retailers taking design in-house all compel Sandy Stein, president of Stein LLC (Minneapolis) to predict that 2007 could be a leaner year than 2006.

Advertisement

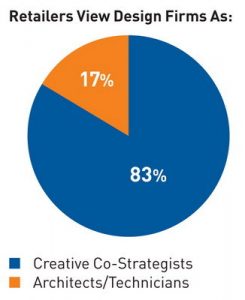

He feels that consolidation within the retail industry has created “a smaller number of sophisticated, demanding survivors who have more clout and greater expectations. This translates into greater competition and fee pressure for design firms.”

Stein also cites rising internal costs to find and keep retail clients. “To provide retailers with the brand-building store environments they are demanding, we are having to invest more in what I call the ‘soft end’ of the business: brand positioning, psychographics and consumer segmentation. While that’s good for both our clients and our business, it also adds levels of complexity and cost for us.”

DAY OF RECKONING?

On top of all those pressures, Stein says the overall economy could cause retailers to postpone new store design projects. “There have been plenty of warnings about slowing consumer spending, fed by such factors as declining disposable income and higher credit-card debt,” he says. “This could lead to a day of reckoning for retailers – and design firms, by extension – at some point.”

But Stein also says there are “many signs that we are entering a design renaissance in which the acceptance of design as a highly valued differentiator is unprecedented.”

Advertisement

When it comes to the store design field in particular, Stein says Target continues to lead the way and buoy the design industry’s prospects. “Target has become our culture’s leading tastemaker through its emphasis on design. This is embodied in its latest retail prototype, which makes a very cohesive brand statement. This will have a ripple effect throughout retail and the retail design community, as a rising design tide tends to lift all boats.”

Photo Gallery3 days ago

Photo Gallery3 days ago

Headlines1 week ago

Headlines1 week ago

Sector Spotlight2 weeks ago

Sector Spotlight2 weeks ago

Headlines1 week ago

Headlines1 week ago

Headlines4 days ago

Headlines4 days ago

Headlines2 weeks ago

Headlines2 weeks ago

Designer Dozen1 week ago

Designer Dozen1 week ago

Headlines2 days ago

Headlines2 days ago