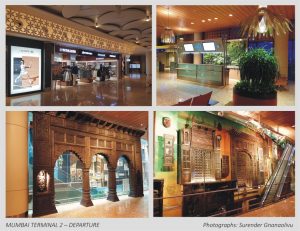

Indian airports, which once played the mundane role of transit hubs for passengers, are today transforming into experiential retail destinations. The privatization of major airports, by operators like GMR and GVK Group, in Delhi, Mumbai, Bangalore, Kochi and Hyderabad, has seen the emergence of world-class passenger experiences for Indian travelers. Five-star waiting lounges, art installations, spas, modern business centers, fine dining and premium retail justify India’s third spot in the world domestic aviation market behind the U.S. and China, according to a recent report from CAPA – Centre of Aviation.

The primary catalyst is the quantitative and qualitative improvement in traffic. As per the Indian Brand Equity Foundation (IBEF), quantitative growth has been 16.52 percent year-on-year to reach 308.75 million across 102 airports in fiscal year 2018. Qualitatively, the increased traffic is dominated by the middleclass, who are powering Indian modern retail at a blistering 20 percent year on year growth, according toET Retail.com. Once dingy airport retail zones have turned into glitzy shopping arcades with the entry of global airport retailers such as the Nuance Group, DFS Group, Alpha Airports Group, Dufry Group, Gebr Heinemann, LS Travel retail and Flamingo International, all of which have introduced to the market the latest concepts from their global portfolios. According to the Centre for Asia-Pacific Aviation, the gross duty-free spend at Indian airports is likely to reach $1.6 billion by 2021.

A secondary influence on growth is increased delayed flights, seen in the dipping “on time performance” rate of 68.75 percent across major airports (as per the Directorate General of Civil Aviation, Government of India). With more free time, many stressed passengers indulge in more than just gift and guilt shopping. It’s no surprise that industry experts estimate the average conversion rate in airport stores to be an impressive 80-plus percent compared to 40-plus percent regarding conventional stores.

International brands have raised the bar of retail experience using updated retail design and visual merchandising practices that address four core objectives: consistent brand signature, design impact, optimal merchandise density presentation and compliance with airport design control norms. As expected, the fashion and lifestyle segments lead in creating exciting formats that set the tone for the look and feel of travel retail in India. Let’s take a closer look at this segment and their retail strategies which I have bucketed into three distinct store models: the compact EBO, the curated MBO and the wellness and beauty stopover.

THE COMPACT EBO

Advertisement

India has seen rapid rollout of EBOs (Exclusive Brand Outlets) across diverse retail markets with different sizing strategies. The average EBO size, between 500 and 5000 square feet, is adapted into airports in compact sizes of 200 to 500 square feet, using their core signature design palettes. Some of the popular global EBOs are Superdry, Armani Jeans, Tommy Hilfiger, United Colors of Benetton, Lacoste, Montblanc, Victoria’s Secret, Mango, Hugo Boss, Basecamp, adidas, Fossil, Accessorize, Swarovski and Samsonite. Popular Indian EBO brands include Forest Essentials, W, Fabindia, Raymond, Zodiac, Hidesign, Da Milano, William Penn, Lenskart, Tanishq, Covo, Ethos and Pepperfry.

THE CURATED MBO

MBOs (Multi-Brand Outlets) include specialty and big box stores featuring multiple categories. The former range between 2000 and 30,000 square feet, whereas the latter is between 50,000 to 100,000 square feet. Analytical productivity planning has helped these retailers curate focused categories to fit into a space of 500 to 3500 square feet in airports. This category has seen the entry of digital-only MBOs, like Lenskart (eyewear) and Naykaa (beauty) into the airport marketplace to acquire new consumers and build trust with their physicality. Some of the popular brick-and-mortar MBOs are Marks & Spencer, Shoppers Stop, Sunglass Hut and Croma Zip.

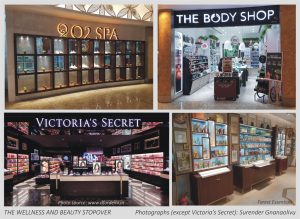

THE WELLNESS AND BEAUTY STOPOVER

Advertisement

The growing Indian wellness and beauty industry is capitalizing on the middle-class consumers’ quest for personalized experiences at airports by offering a large range of premium products and convenient wellness and beauty treatments. While spa brands like O2 are known only for their presence in airports, other premium brands like Kiko Milano, Body Shop, Victoria’s Secret and Forest Essentials have entered the travel retail space with inspiring retail concepts to entice and build brand equity.

CHOCKS OFF, PUSH BACK

Categories like food and convenience add meaningfulness to the fashion and lifestyle offerings to complete the airport retail options for consumers and claim an exclusive revenue head in retail company business plans. As per IBEF, India’s aviation industry is expected to invest U.S. $4.99 billion in the next four years for development of airport infrastructure. Also, the Indian air traveler will soon experience paperless check-in with biometric digital processing called “Digi Yatra” which is expected to substantially increase the time available to shop. With chocks off, airport retail is in the process of pushing back to lift-off to much greater heights that ever before to become the great new frontier of Indian retail.

Surender has more than two decades of experience in the Indian retail industry in retail strategy, store design, planning and development, retail marketing, visual merchandising, writing and academia. He’s held senior positions at leading retailers like Shoppers Stop, Reliance Retail, Mahindra Retail and as a senior retail consultant working with leading retailers and brands in India. Reach him at surenderg.retail@gmail.com.

Headlines1 week ago

Headlines1 week ago

John Ryan2 weeks ago

John Ryan2 weeks ago

Headlines7 days ago

Headlines7 days ago

Headlines2 weeks ago

Headlines2 weeks ago

Headlines1 week ago

Headlines1 week ago

Retail Buzz3 days ago

Retail Buzz3 days ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago