(PRESS RELEASE) SAN DIEGO — Petco Health and Wellness Company, Inc. (Nasdaq: WOOF), a complete partner in pet health and wellness, announced its second quarter 2023 financial results.

In the second quarter of 2023, Petco delivered net revenue of $1.53 billion, up 3.4 percent versus prior year, driven by strength in the company’s consumables business, up 6.8 percent versus prior year, and services and other business, up 30.6 percent versus prior year. Second quarter revenue growth was partially offset by the company’s supplies and companion animal business, down 9.4 percent versus prior year. Net loss was $14.6 million or $(0.05) per share, driven in part by a $0.04 per share increase in interest expense year-over-year, compared to net income of $13.5 million or $0.05 per share in the prior year. Adjusted Net Income1 was $16.3 million or $0.06 per share, compared to $43.5 million or $0.16 per share in the prior year. Adjusted EBITDA1 was $112.6 million compared to $133.5 million in the prior year.

“We continue to focus on execution through an uncertain environment, delivering our 19th consecutive quarter of comp sales growth, with ongoing strength in consumables and services, particularly in vet,” said Petco CEO Ron Coughlin. “With discretionary spending continuing to be pressured, we’re taking numerous strategic actions to strengthen our business, including initiatives to unlock a targeted $150 million in cost savings and productivity enhancements by the end of fiscal 2025. These actions, combined with the enduring competitive advantages of our differentiated offering, will position us even better to deliver sustainable and profitable growth for the long term.”

“In Q2, we delivered solid top line results and strong free cash flow,” said Petco CFO Brian LaRose. “That said, the shift in consumer spending and pressures on our discretionary business mean we’re revising our guidance accordingly. Looking ahead, we remain focused on debt paydown and cash flow, both of which will be supported by our productivity initiatives in addition to tightly controlled expense management.”

In the second quarter of 2023, Petco paid down $25 million in principal on its term loan. In August, the company further paid down an additional $15 million in principal on its term loan for a total of $75 million in principal payments year-to-date. The company continues to target a total of $100 million in principal payments for fiscal 2023 and remains committed to strengthening its balance sheet through de-levering.

The company also initiated a cost action plan in the quarter and estimates annualized gross run rate cost savings of $150 million by the end of fiscal 2025, from merchandise, supply chain, and G&A categories. In year one, the company expects to achieve $40 million in savings. In Q2 2023, the company recorded $6 million in headcount reduction-related charges related to the cost action plan.

Advertisement

(1) Adjusted EBITDA, Adjusted Net Income, Adjusted Earnings Per Share (“Adjusted EPS”), and Free Cash Flow are non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures.

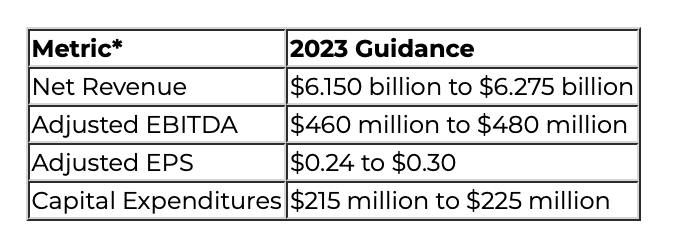

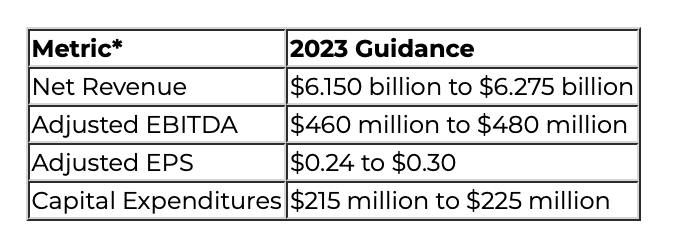

Fiscal 2023 Guidance:

The company is updating its fiscal 2023 guidance for Adjusted EBITDA, Adjusted EPS and Capital Expenditures and now expects:

*Assumptions in the guidance include that economic conditions, currency rates and the tax and regulatory landscape remain generally consistent. Adjusted EPS guidance assumes approximately $145 to $155 million of interest expense, an estimated $43 to $53 million increase in interest expense year-over-year, a 26 percent tax rate, and a 269 million weighted average diluted share count. The Company estimates that the increase in interest expense will impact Adjusted EPS by approximately $0.12 to $0.15 per share. Furthermore, Fiscal 2023 will be a 53-week year, leading to an incremental week of operations. Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures and have not been reconciled to the most comparable GAAP outlook because it is not possible to do so without unreasonable efforts due to the uncertainty and potential variability of reconciling items, which are dependent on future events and often outside of management’s control and which could be significant. Because such items cannot be reasonably predicted with the level of precision required, we are unable to provide outlook for the comparable GAAP measures. Forward-looking estimates of Adjusted EBITDA and Adjusted EPS are made in a manner consistent with the relevant definitions and assumptions noted herein and in our filings with the Securities and Exchange Commission.

Earnings Conference Call Webcast Information:

Advertisement

Management will host an earnings conference call on August 24, 2023 at 8:00 AM Eastern Time to discuss the company’s financial results. The conference call will be accessible through a live webcast. Interested investors and other individuals can access the webcast, earnings release, earnings presentation, and infographic via the company’s investor relations page at ir.petco.com. A replay of the webcast will be archived on the company’s investor relations page through September 7, 2023 until approximately 5:00PM Eastern Time.

About Petco, The Health + Wellness Co.

Founded in 1965, Petco is a category-defining health and wellness company focused on improving the lives of pets, pet parents and our own Petco partners. We’ve consistently set new standards in pet care while delivering comprehensive pet wellness products, services and solutions, and creating communities that deepen the pet-pet parent bond. We operate more than 1,500 pet care centers across the U.S., Mexico and Puerto Rico, which offer merchandise, companion animals, grooming, training and a growing network of on-site veterinary hospitals and mobile veterinary clinics. Our complete pet health and wellness ecosystem is accessible through our pet care centers and digitally at petco.com and on the Petco app. In tandem with Petco Love, a life-changing organization, we work with and support thousands of local animal welfare groups across the country and, through in-store adoption events, we’ve helped find homes for nearly 7 million animals.

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Headlines1 week ago

Designer Dozen2 weeks ago

Designer Dozen2 weeks ago

Headlines5 days ago

Headlines5 days ago

Headlines2 weeks ago

Headlines2 weeks ago

Designer Dozen6 days ago

Designer Dozen6 days ago