Store fixture manufacturers that get two Ds from their retail customers are not failing, they're doing a great job. Those two Ds stand for design and durability, the two most important issues for fixture buyers these days.

Well-designed fixtures are functional, flexible and make the product the star. They reflect an elevated design-consciousness on the part of today's shoppers, one that's been spurred on by such retailers as Apple and Target. And fixture life cycles are getting longer as retailers' lease terms get extended, so they're being forced to stay on the sales floor for ever-increasing periods of time.

These criteria about store fixtures emerged in VM+SD 's second annual survey of the industry, which probed fixture specifiers and manufacturers about the challenges and opportunities they face when doing business together.

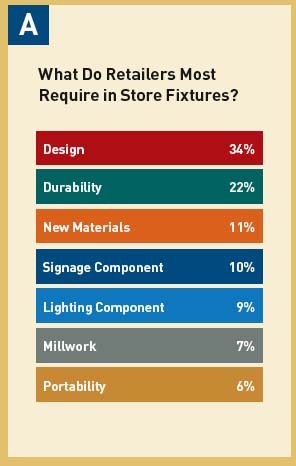

According to retailers and contract retail designers responding to VM+SD's yearly survey, design is by far the most sought-after feature of fixtures that they specify for stores. (Chart A.)

Rick Burbee, creative director at mass merchandiser Sears Holding Corp. (Hoffman Estates, Ill.), says for retail fixtures, design “really relates to functionality. Good fixtures blend into the environment and allow the product to be the focus. But well-designed fixtures are also about authenticity – they must look real and connected to the product they are featuring. Faux finishes and materials often defeat this purpose.”

Barry Ringland, visual merchandising director for lifestyle retailer Brookstone (Merrimack, N.H.), sees a growing emphasis on fixtures that are designed to help communicate the retailer's brand message. That trend, in turn, is traceable to greater design-consciousness on the part of consumers.

“The focus on creating unique and branded environments for retailers has coincided with the continued rising level of taste that consumers have,” says Ringland. “The credit for that can be at least partially attributed to the growing impact of retailers like Target and Apple, who have brought design to the masses and reinforced the importance of design in their buying choices. As retailers try to keep current, the fixtures in a store can help contribute to their success by supporting and reflecting the store's overall design concept.”

However, keeping current doesn't mean switching out fixtures every time the seasons change. Just the opposite. Retailers are demanding an increasing amount of durability from their fixtures, keeping them on the sales floor for as long as possible – maybe even 10 years. “The life cycle of fixtures is getting longer and longer each year,” says Ringland. “The pressures from extending lease terms on stores can quickly affect fixturing whose original life expectancy was 5-7 years. I have seen instances where 5 years have been added to the life of a store environment, as folks in the real estate department wait for the right opportunity to relocate.”

Ken Chance, director, construction and store development, for sport-inspired footwear and apparel retailer Finish Line Inc. (Indianapolis), agrees that durability “is critical in today's retail environment. While the life expectancy of fixtures will vary from retailer to retailer and fixture to fixture – depending on such factors as the way they're used, the amount of traffic in the store and fixture maintenance schedules – the average now is 5 to 10 years.”

ENERGY COSTS LOOM LARGE

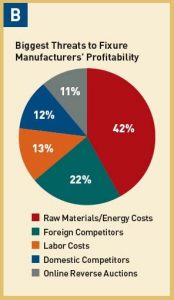

Meeting retailers' expectations is just one of many challenges facing store fixture manufacturers. Rising raw material and energy costs loom largest on manufacturers' current worry list, followed by increasing foreign competition, especially from suppliers based in China; rising labor costs; fierce competition from domestic rivals; and margin-sapping online reverse auctions (Chart B).

“Rising costs of both energy and raw materials are having a huge impact on all businesses, and we are no exception,” says Karin Pryor, vp, marketing, at Leggett & Platt Store Fixtures Group (Niles, Ill.). “As costs continue to escalate and get passed onto us by suppliers, we'll need to look at how that impacts our program pricing to our customers.”

Bob Hardie, principal of Triad Mfg. Inc. (St. Louis), says his firm is working hard to control costs by locking in long-term contracts with suppliers and installing more energy-efficient processes and equipment. “Those costs that can't be controlled are passed through to our final prices,” he says.

TECHNOLOGY'S GROWING ROLE

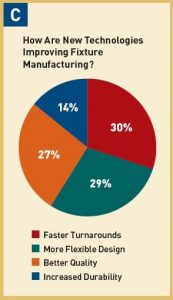

Sophisticated equipment, expensive though it may be, is critical to manufacturing efficiencies and responding to retailers' escalating needs. Fixture manufacturers told us such updated equipment nets them a variety of benefits, including faster turnaround times and better product quality (Chart C).

Hardie says recent equipment buys at his company include a new laser-cutting system, break presses, turret-head fabricator, robotic welder and a nested-bed CNC (computer numerical control) machine.

“By adding these new devices to our existing equipment base, we can offer our customers almost limitless capabilities,” he says. “All of the new equipment is driven by computer programs that are created as the fixtures are being designed. This capability reduces our lead time and price, while improving our quality.”

Not all the technological upgrades are taking place on the factory floor. Hardie notes that Triad has also implemented a new enterprise resource planning (ERP) system that centrally manages the paper trail associated with each order. “With this system, we are able to create new fixtures and re-create repeat fixtures much quicker,” he notes. “Bills of materials, material purchase orders, production cut sheets and job travelers are all linked together and generated much more quickly than they were before.”

CREATING A 'EUREKA' MOMENT

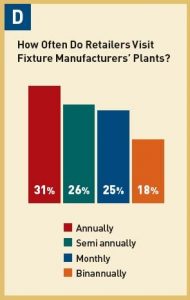

While more fixture manufacturers are relying on high-tech equipment to stay competitive, many of their customers still rely on old-fashioned shoe leather to ensure that what they've ordered is what they get. Nearly 60 percent of the retailers and designers responding to VM+SD's survey say they make first-hand plant visits. Though there is wide variety of opinion on how often to make such visits (Chart D), manufacturers and clients alike agree that such tours are worthwhile.

Fixture manufacturers view plant visits as a mutual education process, says Leggett's Pryor. “Such visits provide us with the opportunity to share with the retailer the specifics of the manufacturing process, enabling them to view the work in progress, see the equipment involved and better understand the challenges associated with meeting their specifications.”

Retailers also see such nuts-and-bolts benefits from plant visits – but say something more often takes place. “Visits to a good manufacturing partner can also result in what I call a 'eureka!' moment, when starting a new project or trying to solve a perplexing problem,” says Brookstone's Ringland. “The dual needs of saving money and achieving the highest quality level possible can usually be satisfied by a well-timed visit.”

Sears' Burbee has experienced the same thing. “I have often been hit with great ideas while walking through a manufacturing plant,” he says.

CAUTIOUSLY UPBEAT OUTLOOK

Despite all the market pressures they face, fixture makers are optimistic about their prospects for the balance of 2006: A whopping 85 percent say they think the current year will be better than last. But that sunny outlook is tempered by the thicket of cost and competitive pressures they must navigate.

Says Hardie: “I feel the retail fixture business is very strong, but I do not feel the cost pressures on fixture purchases are lessening. Our customers continue to be very cost-conscious, and low prices are higher on their priority list than they were 5 years ago. We try to bring them the best value, which is a combination of the best price, product and service.”

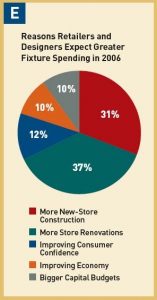

The upbeat expectations of fixture manufacturers are reflected in the spending plans of retailers responding to the survey. Over 70 percent said their spending plans for 2006 represented an increase over last year, as they build and renovate more stores (Chart E). But that upbeat outlook is invariably paired with cautions and caveats.

“The value of fixturing and refixturing as a means of refreshing store environments has increased and represents a decent return-on-investment for retailers,” notes the Finish Line's Chance. “Pressures on fixture purchases remain, however. We still want more for less.”

Photo Gallery2 weeks ago

Photo Gallery2 weeks ago

Headlines6 days ago

Headlines6 days ago

Headlines2 weeks ago

Headlines2 weeks ago

Headlines2 weeks ago

Headlines2 weeks ago

Headlines5 days ago

Headlines5 days ago

Headlines2 weeks ago

Headlines2 weeks ago

Headlines4 days ago

Headlines4 days ago

Designer Dozen1 week ago

Designer Dozen1 week ago